CFO

Services

Virtual CFO Services

For businesses seeking to optimize financial strategies without the commitment of a full-time CFO, our dedicated Virtual CFO ensures accelerated business growth, expert navigation through change, and the attainment of your business goals.

What is a Virtual CFO?

Interested in learning about Virtual CFOs? Hiring experienced full-time CFO can cost upwards of $225,000 per year, not to mention vacations, bonuses, and benefits. For new and growing businesses, this expense can be significant. That’s where a Virtual CFO comes in as a great solution.

At Weinberg Partners, we possess the expertise, tools, and resources to offer organizations a comprehensive financial and accounting framework. From Staff Accountants to the esteemed CFO position, we cover it all. With our flexible outsource model, you can tailor a service package that perfectly aligns with your unique requirements while staying within your budget. Let us handle the numbers, so you can focus on your business goals with confidence.

Build your business. Hire a virtual CFO to beat the competition.

Wondering how our Virtual CFO service works? Let us break it down for you.

When you partner with us, you’ll be matched with a dedicated CFO and a team of virtual accountants, CPAs, and tax professionals. They’ll work closely with you, providing valuable guidance to steer your business towards success. But our services go beyond basic bookkeeping and accounting.

We offer comprehensive financial reporting, forecasting, and a range of tax services designed to give you peace of mind. With us, you don’t have to worry about surprises at the end of the year. We’re here to support you throughout the year, helping you plan your taxes effectively.

If your business is growing and you’re in need of professional financial consulting, our Virtual CFO service is the perfect fit.

Have you asked these important financial questions for your business?

How much money should be in your cash reserve?

What's the ideal amount of cash to keep in your operating account? How to effectively manage your cash in the short-term and long-term?

Is your pipeline strong enough to maintain your current and future cash position?

How can you calculate your ideal pipeline size?

What data is necessary to expand your customer base(s) successfully?

How can you ensure a steady cash flow?

What should be included in your short-term and long-term forecasts?

How can you analyze the impact of hiring employees or contractors on your long-term financial forecast?

When is the best time to prepare your business for sale and how do you get it market-ready?

Pricing

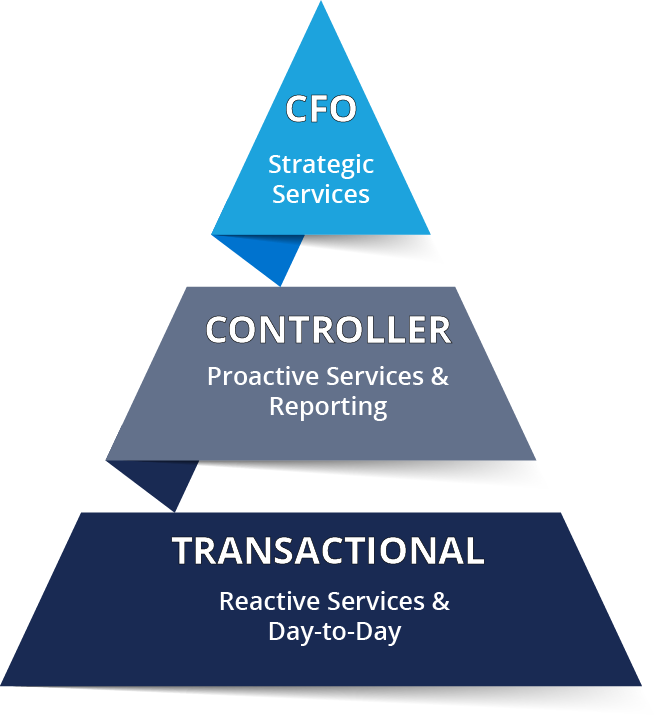

TRANSACTIONAL

- Reactive Services

- 4 Week Onboarding

- Month-End Close

- Financial Statements

- Up to 1 Scheduled Meeting/Month

- Unlimited Online Support

- Cash Flow Management

- (Optional) Personal Tax Services

- (Optional) Business Tax Services

- (Optional) Tax Planning/Projections

CONTROLLER

- Proactive Services

- 6 Week Onboarding

- Month-End Close

- Financial Statements

- Up to 2 Scheduled Meetings/Month

- Unlimited Online Support

- Company-Wide KPIs

- 12-Month Forecasting

- Cash Flow Management

- Revenue Recognition

- (Optional) Personal Tax Services

- (Optional) Business Tax Services

- (Optional) Tax Planning/Projections

VIRTUAL CFO

- Strategic Services

- 8 Week Onboarding

- Month-End Close

- Financial Statements

- Up to 6 Scheduled Meetings/Month

- Unlimited Online Support

- Company-Wide KPIs

- 12-Month Forecasting

- Cash Flow Management

- Revenue Recognition

- Incentive Plans

- Performance by Project

- Department Performance

- Customized Department Reports

- Bank Relationships

- Director Meetings

- Resource Planning

- Payroll & Contract Management

- (Optional) Personal Tax Services

- (Optional) Business Tax Services

- (Optional) Tax Planning/Projections

Speak With An Expert

Looking for more insights on running a successful company?

Subscribe to our newsletter, OnPoint!

Weinberg Partners LTD

Las Vegas Office

9205 W. Russell Road, Suite 240 | Las Vegas, Nevada 89148 USA

Chicago Office

250 Parkway Drive, Suite 150 | Lincolnshire, Illinois 60069 USA

Washington DC Office

211 N Union Street, Suite 100 | Alexandria, Virginia 22314 USA