1. The common cash flow mistake

One of the most common mistakes trade business owners make when trying to improve their cash flow is only accounting for what’s on their profit and loss statement. When someone does this, they’re failing to realise that profit and cash are not the same things.

As the saying goes, “Revenue is vanity, profit is sanity, cash is reality”.

The profit and loss statement doesn’t tell you anything about cash — it’s simply an indication of the profit that comes as a result of the business’s sales and expenses. But there’s a lot more to cash flow than that.

Cash flow concerns:

-

- Assets purchased

- Money owed

- Payment schedules

- Work in progress

- Director loans

- Other considerations with real dollar costs.

So, if you’re running a trade business based on the profit and loss statement alone, then what you’re seeing on paper may not reflect what’s actually happening in regard to your business’ finances.

2. Understanding the balance sheet

Understanding the balance sheet can be a challenge, but you still need to understand it. If you can comprehend the balance sheet in tandem with your profit and loss statement, then you’re away — you’ll have no problem uncovering your cash flow.

3. Your four-chapter cash flow story

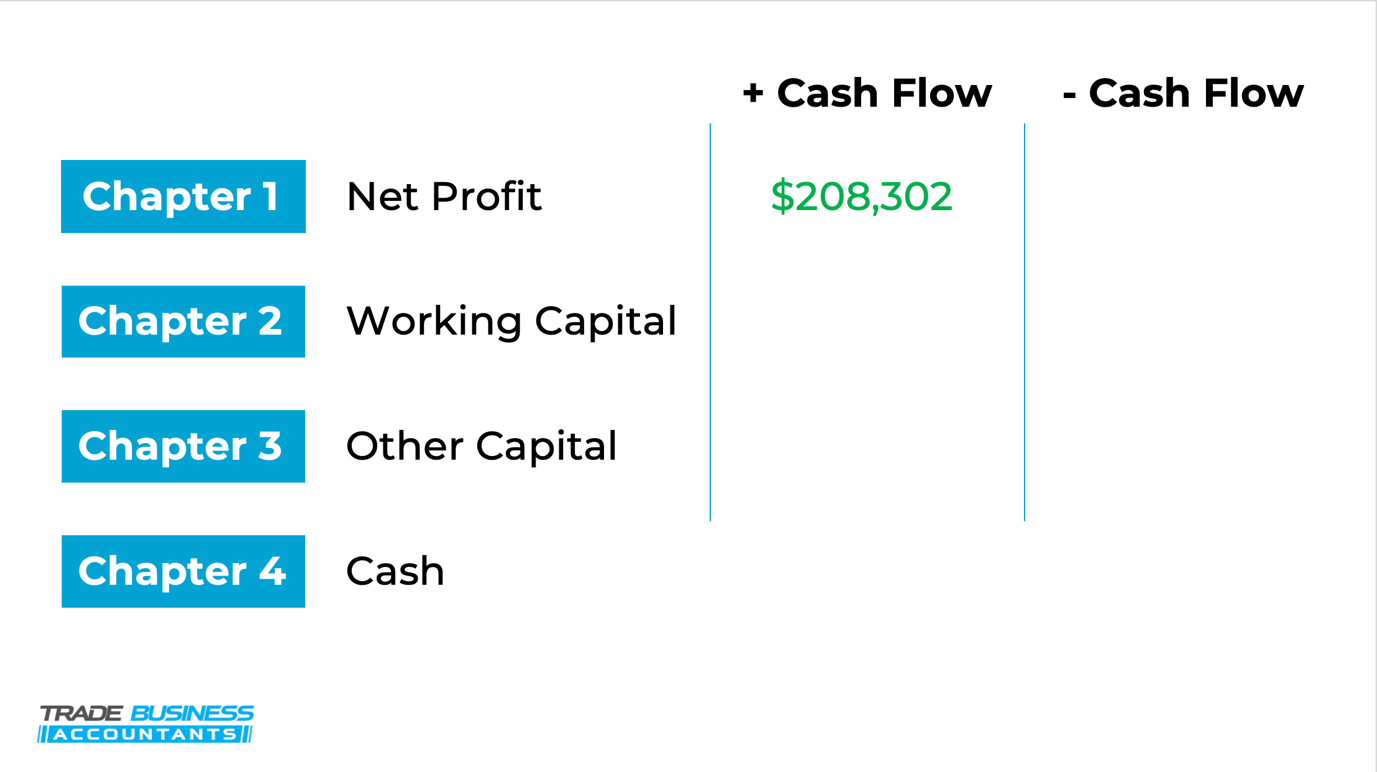

To improve your cash flow and keep more profit in your trade business you need to look at your numbers like a story that’s told in 4 chapters. These 4 chapters represent each component of the formula we use to calculate cash:

Chapter One: Net Profit

Found at the bottom of your profit and loss statement, net profit is the profit your business makes after every cost has been factored in.

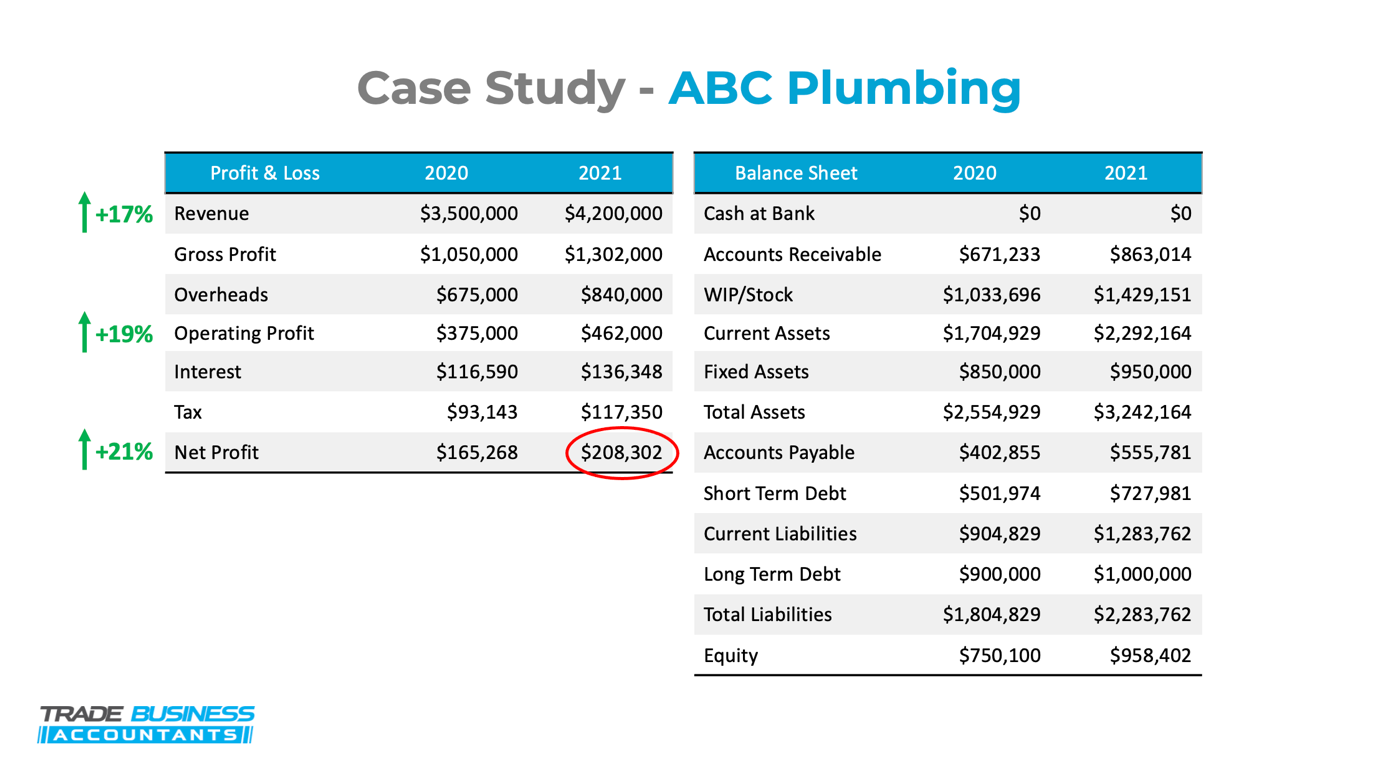

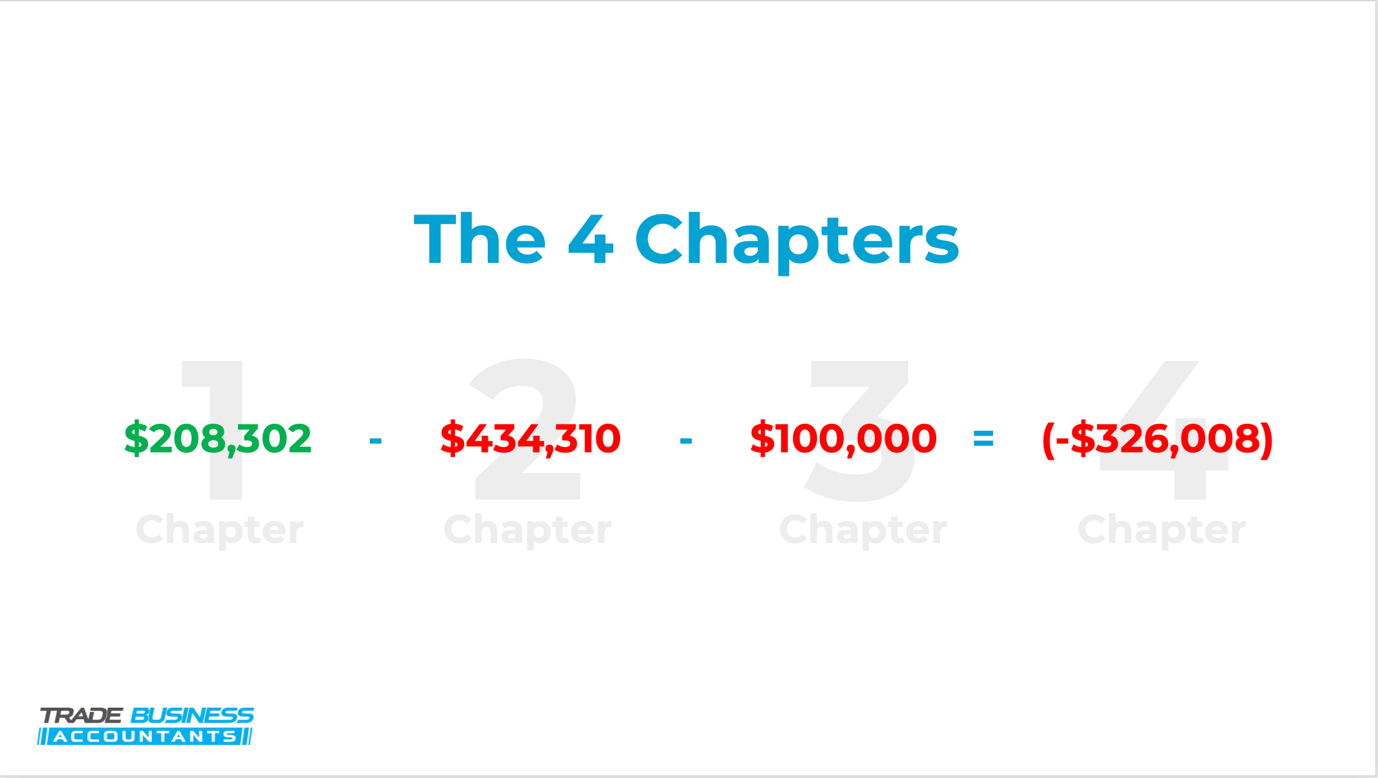

As we’ve outlined, this is often as far as people get with analyzing their finances, which shouldn’t be the case. To prove this point, let’s explore a real case that Trade Business Accountants had with a company that we’ll refer to as ABC plumbing. In the year before working with Trade Business Accountants, ABC Plumbing had grown revenue by 17%, operating profit by 19%, and net profit by 21%. Business appeared great. But, while ABC Plumbing did have a net profit of $208,302, they had also lost -$326,000 in cash.

Net profit sits in the left-hand column (meaning that it positively affects cash flow) because the more profit you make (assuming you collect it), the more cash you’ll generate in your business.

Chapter Two: Working Capital Invested

Working capital is the amount of cash needed to run your business over the short term. This is where the balance sheet comes in.

On your balance sheet, there are only three lines that determine working capital:

-

- Accounts receivable – the money owed to you by customers.

- Works in progress (WIP) or stock – the work you’ve done at your expense that isn’t yet invoiced for or stock in the form of supplies on hand that are waiting to be allocated to a job and invoiced).

- Accounts payable – the money owed to your suppliers.

These three things make up your working capital because they largely determine the amount of cash coming in and going out of your business in order for it to operate.

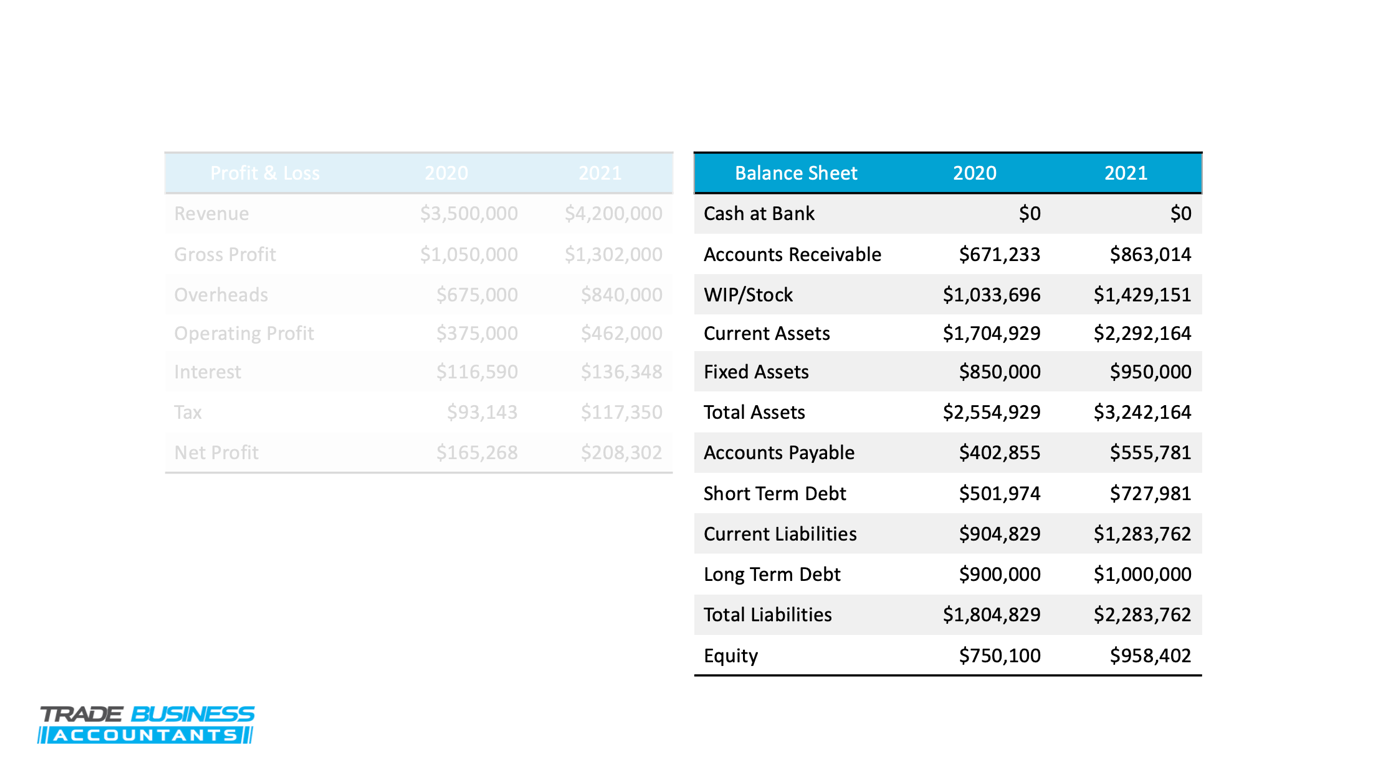

At this stage, you want to calculate the working capital invested this year on top of last year. This will show if the profit made this year was used to fund any increase in working capital from the year before.

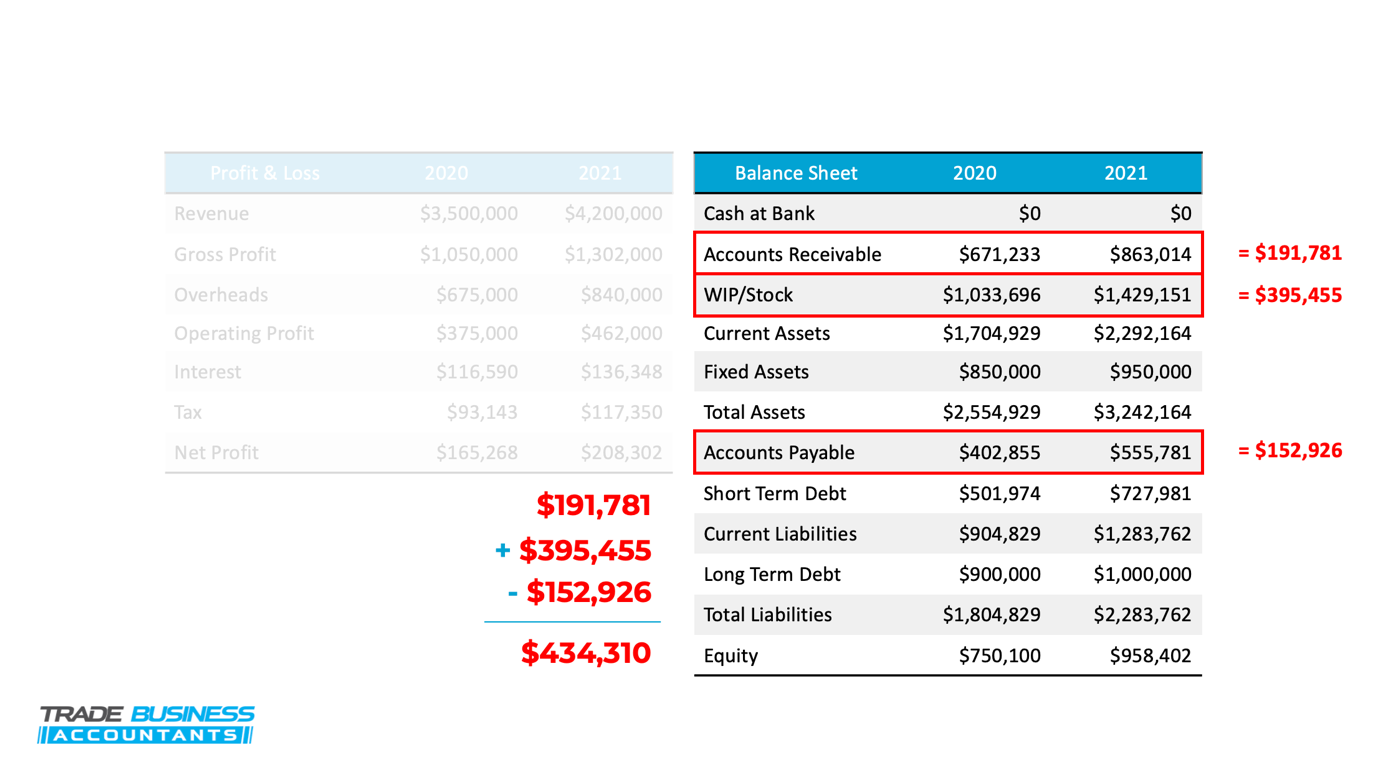

To find the working capital invested, calculate the difference in accounts receivable (e.g. the difference between 2020 and 2021), plus the difference in work in progress (WIP) and/or stock, minus the difference in accounts payable.

In the example above, accounts receivable has increased $191,781 ($863,014 – $671,233 = $191,781), WIP or stock has increased by $395,455, and accounts payable has increased by $152,926.

Meaning, all up, ABC Plumbing invested an extra $434,310 in working capital in 2021 compared to 2020.

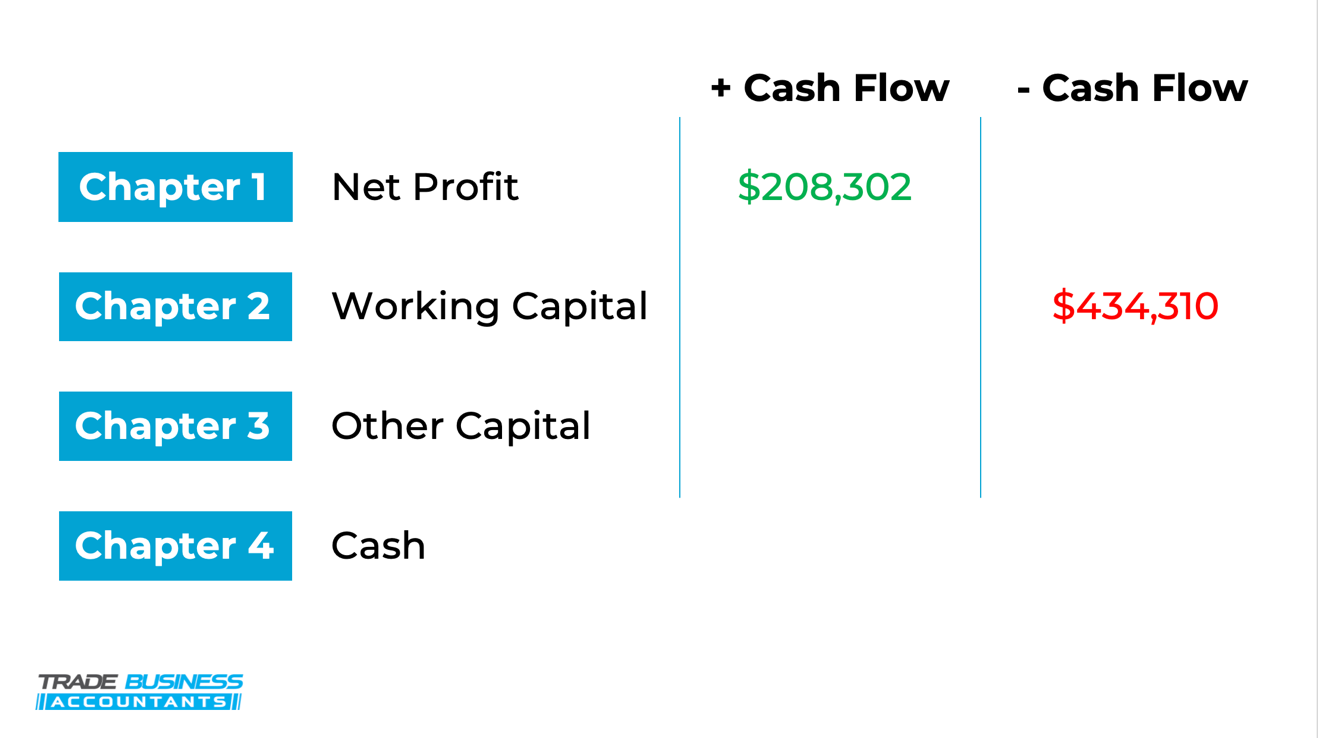

This is where working capital invested sits in the four chapters:

It’s sitting in the right-hand column (which has a negative effect on cash flow) because the more working capital invested, the more cash your business needs to operate.

Chapter Three: Other Capital Invested

To make the balance sheet simple, we’ll refer to anything other than working capital, as just ‘other capital’. These are complicated accounting terms like accruals, prepayments, provisions, deferred tax, other current assets, liabilities, etc. that have little to do with the operational management of your business, so just leave that for your accountant and group them as ‘other capital’.

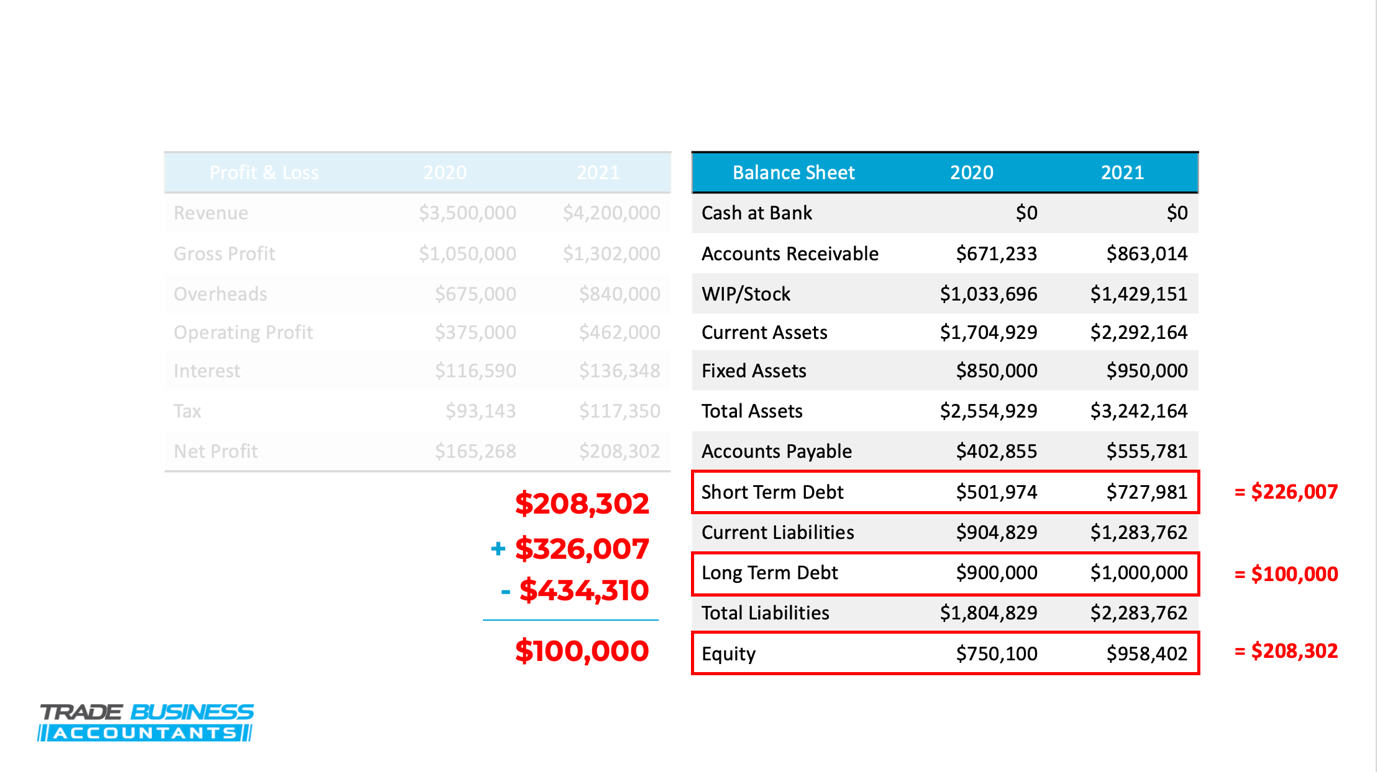

To calculate other capital, we’ll have to take another look at the balance sheet. The formula is the difference in equity (the value of the business if all assets were sold and all debts were paid off), plus the difference in debt (the value that is owed to creditors like banks), minus working capital invested.

In the example below, the combination of debt and equity represents the total increase in funding, or capital, in the business in 2021, used to fund the increasing cost of operations in 2021. So, by subtracting the working capital invested figure from this total, we can calculate the leftover, which is other capital invested in 2021.

Here, we can see that ABC’s equity has increased by $208,302, and the combination of short-term and long-term debt has increased by $326,007. That means, once we subtract the working capital amount of $434,310, we can see that they’ve invested an extra $100,000 in ‘other capital’ in 2021.

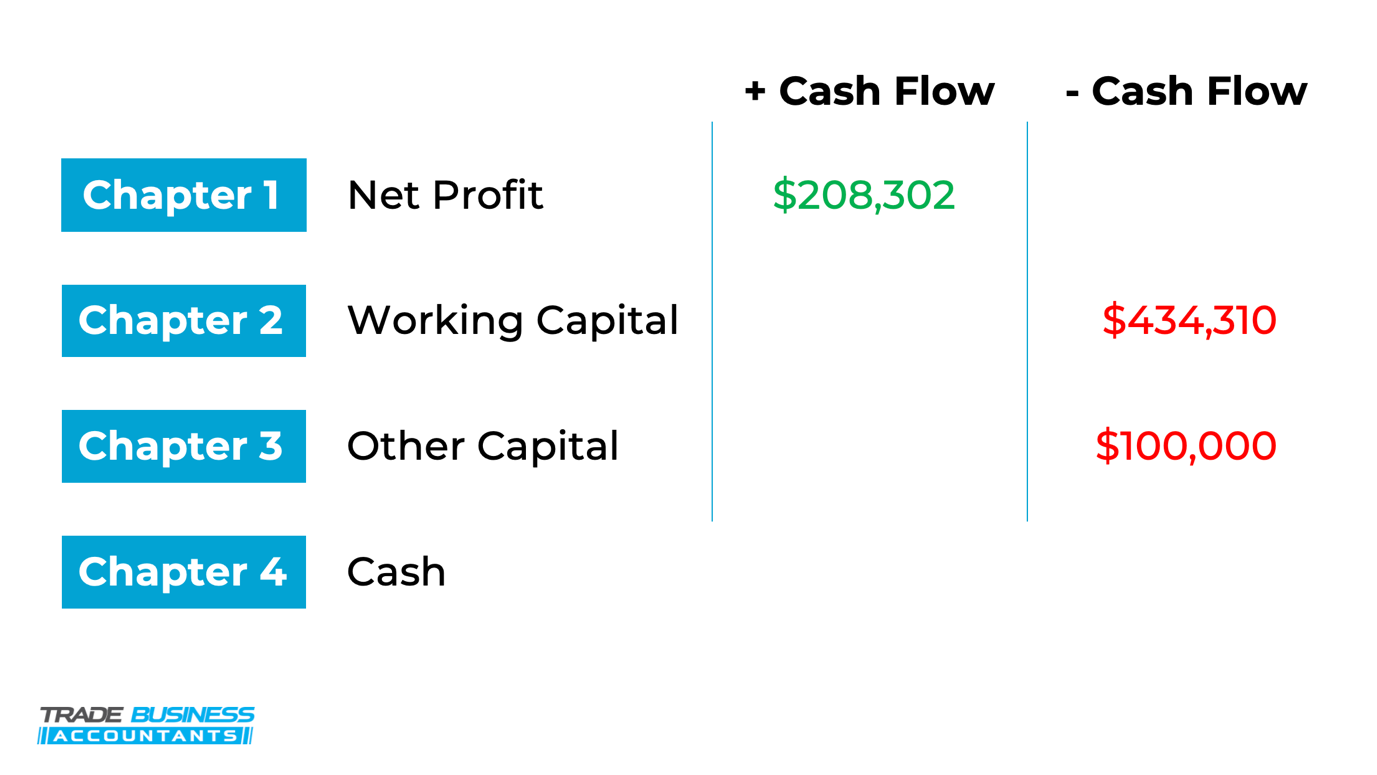

This is where other capital invested sits within our four chapters:

It also sits in the right-hand column which negatively affects cash flow. Like working capital, the more you invest in other capital, the more cash that gets drained from your bank account.

Chapter Four: Cash

This is the money left over after everything else has happened — arguably the most important factor of all. To calculate cash, we use the following formula:

In this example, as we said, despite everything looking great on the profit and loss statement and making $208,302 in Net Profit, ABC Plumbing actually lost $326,000 in cash.

This is why you can’t improve your cash flow without looking past net profit and exploring all aspects of your business’ finances. If ABC were to continue only focusing on what their profit and loss statement was telling them, they would have remained fooled into thinking business was great and things could have gotten much, much worse.

So, now that you know how to understand your cash flow, let’s talk about improving it.

4. Improve cash flow & keep more profit

Flooding your business with more cash and keeping more profit comes down to two things: increasing profit & decreasing working capital. This is done through 7 key levers in your business:

To increase profitability, we look at:

-

- Price

- Volume

- Cost of goods sold (COGS)

- Overheads (found on the profit and loss statement)

To decrease working capital, we discuss:

-

- Accounts receivable days

- WIP or stock days

- Accounts payable days (All found on the balance sheet).

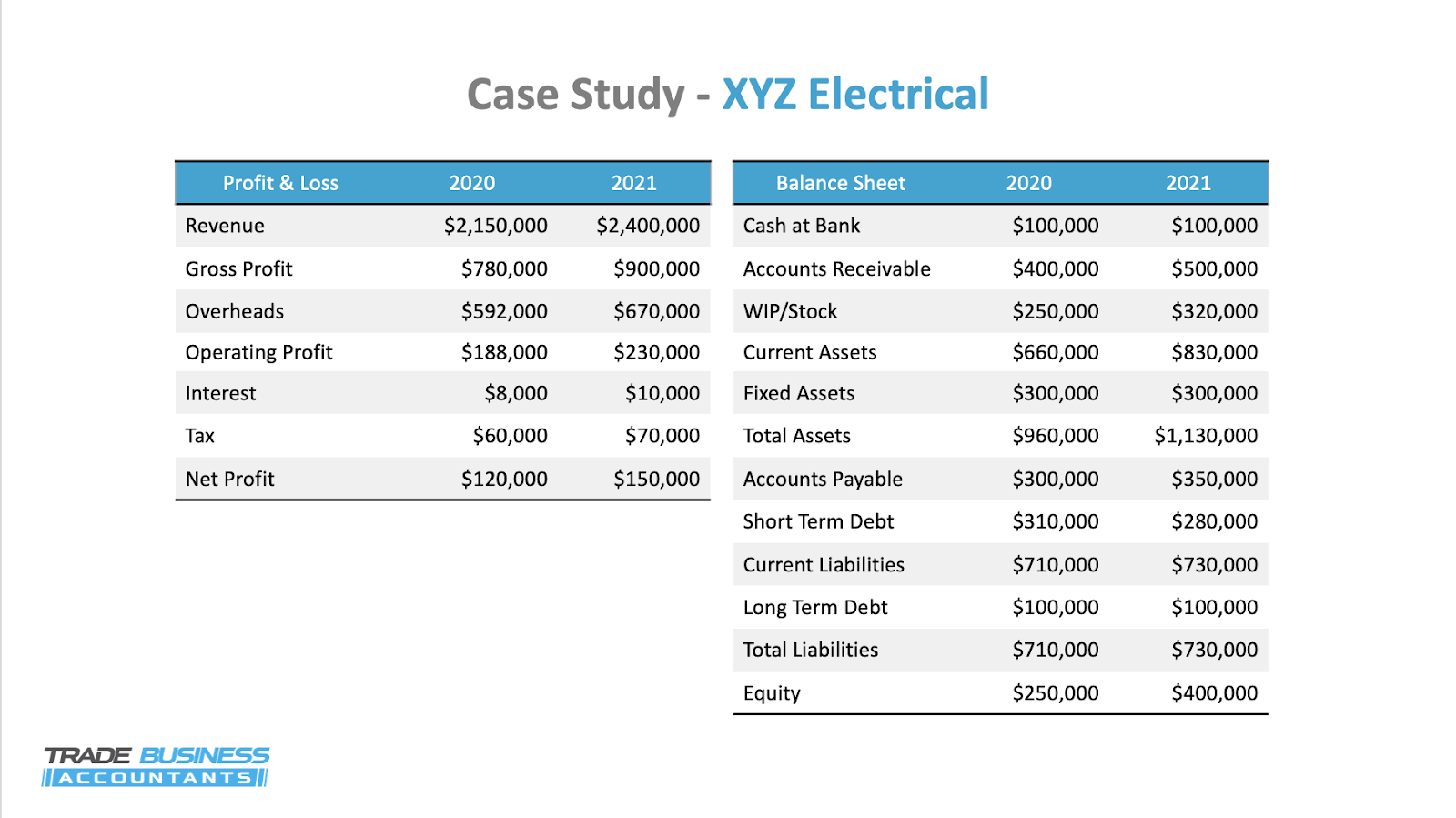

If you want to make more cash in your business, these are the only seven things you need to know. To prove it, here’s another case study of a Trade Business Accountants client, let’s call them XYZ Electrical.

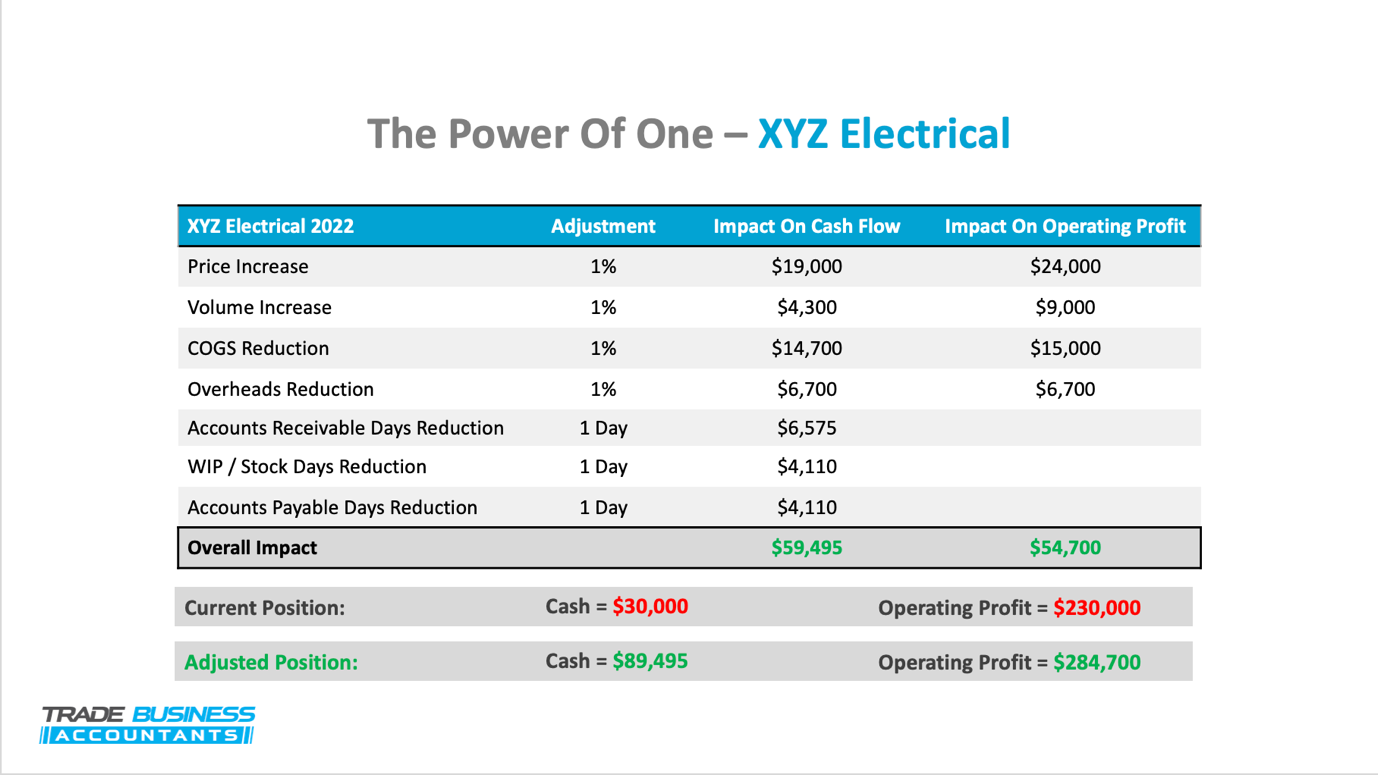

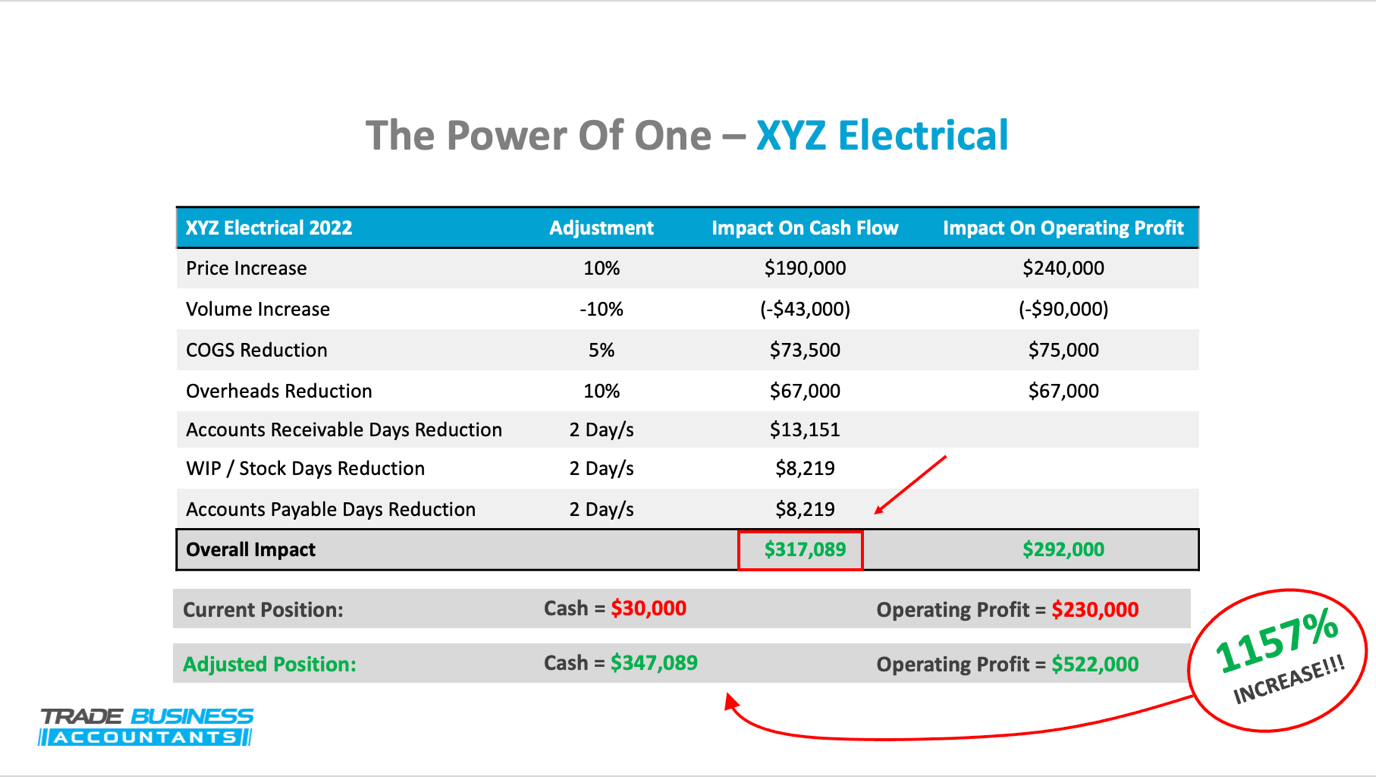

By adjusting their 7 levers by only 1% or 1 day, XYZ could’ve put an extra $59,495 cash in their bank account (a 300% increase in cash!). But, instead, XYZ Electrical increased their prices by 10%, which caused them to lose roughly 10% of their overall volume.

A 10% decline in work would cause most trade business owners to panic, but when the price is 4.5 times more sensitive to cash than volume (every 1% increase in price equated to $19,000 in cash for XYZ, whereas every 1% increase in volume equated to $4,300), the decision to increase prices was a no brainer, even if it meant sacrificing some work. Investing $1 to get back $4.50 meant XYZ Electrical made $147,000 more in cash.

Outside of price and volume, the cost of goods sold (COGS) was reduced by 5% due to greater efficiency in delivery, better structure/planning, and better deals from suppliers. Overheads were reduced by 10% by removing unnecessary expenses that weren’t adding any value to the business. Receivable days, payable days, and WIP/stock days were reduced by 2 days, simply by invoicing and collecting money faster, while restructuring how they pay their suppliers.

All up, these tweaks resulted in an extra $317,000 cash — just by focusing on the 7 key levers, XYZ Electrical increased their cash by 1157% from the prior year!

This is why, if you want to improve your cash flow and keep more profit, you need to understand your whole 4-chapter story and then only focus on the 7 key levers found on your profit and loss statement and balance sheet. Think, how many 1% or 1-day changes can you make in your business?

5. Get started on your own trade business

To get started and make things easier, Trade Business Accountants have created an Ultimate Cash Flow Boosters Checklist with 101 strategies that you can use to find the hidden cash flow leaks in your business across the 7 levers.

g.

This is a guest article written by Trade Business Accountants, a specialist tax, accounting, and business advisory firm based in Australia.

This article is not intended to be financial advice. We recommend discussing any specifics with your accounting provider.