As a small business owner, tax season often brings a pile of paperwork, and understanding which forms to file for your contractors can feel like a guessing game.

Here is a straightforward overview of the all-important 1099 tax forms.

Think of 1099 forms as ‘information returns.’ They tell the IRS and the person you paid (the recipient) how much money you paid them during the year. This ensures everyone is reporting all their income.

Which Form Do I Need to File?

The two forms you’ll encounter most often are Form 1099-NEC and Form 1099-MISC.

Form 1099-NEC (Nonemployee Compensation):

This is the most common for small businesses. You’ll use this form to report payments of $600 or more you made to an individual or unincorporated business (like a freelancer, independent contractor, or gig worker) for services performed for your business.

Form 1099-MISC (Miscellaneous Information):

This form is for other types of payments, also generally $600 or more, that are not compensation for services. Examples: Payments for rent (for office or equipment), prizes, and awards.

Please be aware that there are other Form 1099’s for different types of income, so if the NEC and the MISC don’t cover what you received payment on, then get in touch with us.

Quick rule of thumb: If you paid an individual or non-corporate entity $600 or more for their services, use the 1099-NEC. For most other business-related payments that meet the threshold, use the 1099-MISC.

Please note that beginning with the 2026 tax year, the threshold for forms 1099-K, 1099-MISC, and 1099-NEC increase to $2,000 and are increased each year thereafter based on inflation.

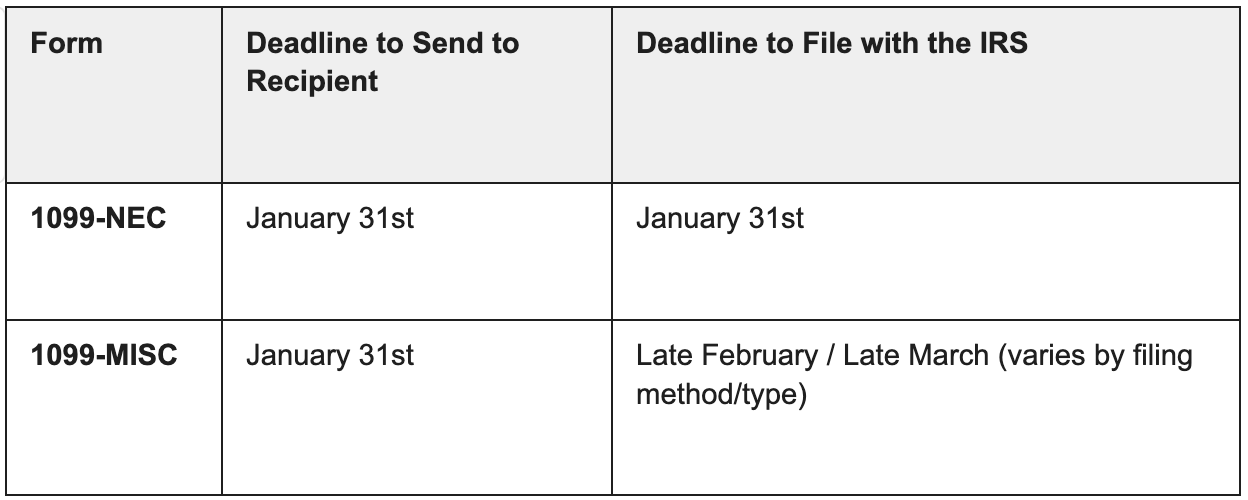

Key Deadlines to Mark on Your Calendar

Meeting the deadlines is crucial to avoid penalties!

The most urgent deadline is the 1099-NEC on January 31st (for both your contractor and the IRS). If January 31st falls on a weekend or holiday, the deadline is the next business day.

Best Practice: The W-9 is Your Best Friend

You can’t file a 1099 without the right information from your contractor! Before you issue any payment, you should have them complete a Form W-9, Request for Taxpayer Identification Number and Certification.

The W-9 provides the individual’s:

- Legal Name

- Address

- Taxpayer Identification Number (TIN), which is usually their Social Security Number (SSN) or Employer Identification Number (EIN).

Having a W-9 on file before you pay ensures you have all the necessary information for a smooth filing process in January. It’s an easy step that saves you a massive headache later!

Remember, failing to file or filing late can result in penalties, so preparation is key. Keeping good records throughout the year makes tax time a breeze.

If you are still unclear how to handle your 1099’s – get in touch with the team here and we will happily let you know what form you are required to either send or receive.

The following content was originally published by BOMA. We have updated some of this article for our readers.